It has been a while since I sat down to write about property taxation on this blog. It has also been 6 years since the issue actually progressed to a vote in our General Assembly. If the issue is to advance, it must be advanced strategically, where personalities and egos are set aside to advance the principles for the issue of changing how we fund education. We must ask ourselves the very difficult questions of inequity and injustice to assure that whatever is done, does not advance the same.

I believe, as I have always believed, that property taxation to fund education is the greatest moral injustice ever perpetrated upon society in the entire history of taxation.

I also believe that the education of future generations is an essential part of that same society. I believe that it is the responsibility of all of us to provide for, as our state Constitution requires, a thorough and efficient system of education. I do not believe that it is necessary to do this through a burden that robs from future generations rather than providing for stability to those who come after us.

The argument of being anti-property tax requires that I must be anti-education is, in my opinion, just one excuse in a long line of excuses to perpetuate this grave injustice based solely on the ease at which property taxes have historically been levied and increased.

I believe that property taxation threatens our Constitutionally protected right, in Article 1, Section 1 of our State Constitution, to acquire, possess and protect property. I believe that property taxation is regressive taxation, impacting those with the least ability to pay the hardest making it more difficult for them to purchase homes, maintain those homes and provide for the future security of themselves and their families forcing more lower income families into renting where they pay more in rent then they would pay for a mortgage on the same property. The cost of that rent is, of course, driven in large part, by the rate of taxation.

Property taxation is regressive taxation in that, while the wealthy can naturally afford higher priced homes, so they appear, on the surface, to be paying higher property taxes. When the cost is analyzed from the perspective of personal wealth, we find time and again that those in lower income brackets are paying a much higher percentage of their income to property taxation, both through mortgage and rent, for the purpose of providing for education.

The entire system of property taxation is based on a flawed premise of property assessment which can easily be argued, will never truly or accurately reflect the actual value of a home in a housing market that is constantly fluctuating. In counties where we have seen county-wide reassessment of property, we see that these assessments are quickly distorted requiring adjustments through the common level ratio which is supposed to keep property taxation, a system that is already inequitable, more equitable. It fails to do that which it was designed to do.

The common level ratio is applied at the county level. It is an average based on a county wide evaluation of increasing property values. It is safe to say that our land locked third class cities, where expansion is difficult and home values do not increase at the same rate as the surrounding rural areas, when that average is applied it results in higher costs to the cities where the majority of our lower income families dwell and lower total cost for the wealthier surrounding rural areas.

To complicate matters, these county wide reassessments are expensive propositions that only add to the cost of total property taxation while ultimately failing to do what they are intended to do…keep property taxation equitable. To even remotely come close, reassessment would be required every three to five years at a cost of millions to the community each time all of which must be realized through property taxation. In short, we would have to pay more in property taxes to provide for constant reassessments to a system that fails to fully accomplished that which it is supposed to do.

Paying for all of this through property taxation is not accomplished based on ability to pay but rather on the arbitrarily determined value of a home which, as previously stated, never truly reflects the actual value of the home. It is applied through a millage rate that is not determined by income or ability to pay, it is determined by a percentage applied to a value that will incorrectly reflects the actual worth of the thing being taxed.

None of this, in no means, is to inject a class warfare argument into this debate. It is merely to state that there is inequity in the application of property taxation because it is based on an assumption of worth that never truthfully reflects actual value or considers ability to provide for the demands of poperty taxxation or the increases which will most assuredly follow.

For lower income families in third class cities, we see greater growth in rental properties requiring greater needs for rental assistance through government funded programs all while preventing these lower income families from acquiring the necessary resources they need to provide for the substantial down-payments necessary to purchase a home.

This contributes to a more transient population, especially in our third class communities, which adds to the cost of education. As reason dictates, this also inflates the cost of property taxation.

Rather than encouraging the establishment of roots in our communities and in our school districts, paving the way for more stable communities, we have a system of taxation that encourages transient populations contributing to instabilities and uncertainties in planning and preparation for the future of those same communities all at a cost which further inflates the property tax.

In short, property taxation is more expensive to maintain than it’s worth, while proving to be regressive, unstable and inequitable for those who have to pay the tax.

The argument of stability for those who impose and collect the tax is not a substantive argument as evidenced by the number of people, especially in our third class cities, who default on their tax payments which then places a greater burden on those who do, requiring further necessary increases in property taxation to provide for those who have defaulted. Stability should never be confused with ease. Stability should require Stability for both those who impose and those who must pay the tax. For those who pay, there is nothing stable about property taxation.

While those who can afford to still provide for the increases without sacrificing other essentials may not realize the extreme instability it cause for those who cannot, that does not dismiss the fact that there are many who must sacrifice or face losing their homes which includes the potential of losing their entire investment in that home where, during the tax sale, the primary concern is in meeting only the lost tax revenue and not on providing for just compensation in the seizure of that property for the purpose of the tax sale.

For those who will be unable to meet the tax demand and will face losing that homes, further costs apply to the communities in the forced removal of that individual from their home. Those costs which are not met in the resale of that property are passed on to the rest of the community through property taxation.

As property taxes continue to increase statewide to the tune of about $500 million a year; while these costs are pushed more on the lower income families forcing them to pay a much higher percentage of their income to this system of taxation, we see this generating a greater need for more government programs to help to provide for the needs of those lower income families. Providing for those programs, however necessary, come at cost, some of which could be avoided if we seriously considered changing how we fund education at the state level.

Our homes are not simply wood, brick and mortar structures. They are the place where community begins. They are, as James Otis argued in 1761, our castles, no matter how humble. They are places that are windows to our soul. Strangers, upon visiting a new home will be able, if observant, to see much of the personality of the individual.

When a new home is purchased that home will begin the transformation to reflect the interests and nature of the persons moving into that home. Understanding this, it should be no wonder that those who have cherished the principles of liberty have tied those liberties, those rights, to the precious commodity that is their home…their property.

It becomes a step of Independence…of self-reliance…where we can break free of the shackles of dependency on others to provide for ourselves. It becomes a part of the natural growth of all human beings where we should be able to say that this truly belongs to me. It is my life, my liberty, my property in the fulfillment of the promise in the protection of our right to acquire, possess and protect our property. A promise that has sadly been negotiated away in the name of ease nearing the injurious cost of establishing inequity and in doing so becomes the moral injustice I believe it to be.

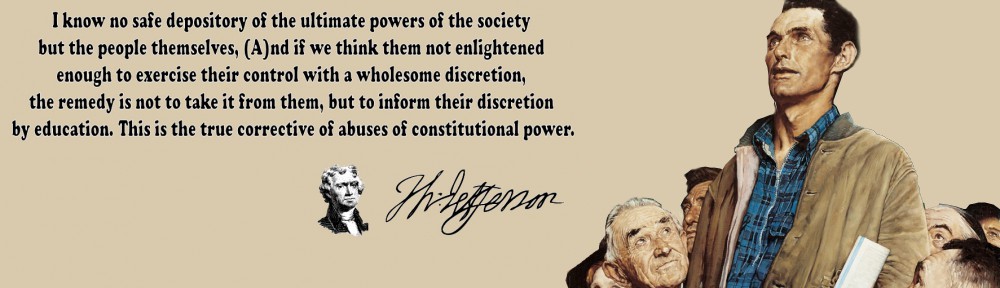

I agree with Thomas Jefferson when he wrote “laws and institutions must go hand in hand with the progress of the human mind. As that becomes more developed, more enlightened, as new discoveries are made, new truths disclosed, and manners and opinions change with the change of circumstances, institutions must advance also, and keep pace with the times. We might as well require a man to wear still the coat which fitted him when a boy, as civilized society to remain ever under the regimen of their barbarous ancestors.”

I fully understand that this is a dramatic shift in thinking and policy from the current paradigm of education funding. I understand that such a change should not be entered into lightly; that no single person has all the answers in how this should be done. That being said, my conviction remains that it must be done. I believe it must be done in a way that is as equitable to all as possible by not shifting the replacement revenue need on to one group while sparing another from any such responsibility. The funding of education as required by law is either the equal responsibility of all or it is the responsibility of none.

To paraphrase Thomas Paine: Heaven knows how to put a proper price upon its goods; and it would be strange indeed if so celestial an article as freedom should not be highly rated. No power, no agency of government, should have the power to bind us in all cases whatsoever with regards to our homes and if being bound in this manner, is not slavery, then is there not such a thing as slavery upon earth. Even the expression is impious; for so unlimited a power can belong only to God.